It's time for our annual Bitcoin Pizza Day review, where we take a look at the price of Bitcoin on this day since it was created. For those that don’t know, we’ll provide you with the full story on what Bitcoin Pizza Day is and how this came about. We’ll also take a look at the prices on the day over the years, illustrating Bitcoin’s market performance over the 12 years.

What Is Bitcoin Pizza Day?

Just one and a half years after launching Bitcoin was used to execute a trade in the real world. Celebrated each year on 22 May, Bitcoin Pizza Day marks the first time Bitcoin was used for a real world transaction.

The Man Behind It All: Laszlo Hanyecz

On 18 May 2010, a man living in Florida by the name of Laszlo Hanyecz offered anyone on the BitcoinTalk forum 10,000 BTC in exchange for delivering two pizzas to his house.

Four days later a man from California took him up on this offer and got two large Papa John’s pizzas delivered for the (then) equivalent of roughly $30. The deal was executed perfectly, and Hanyecz enjoyed the pizzas from the comfort of his home.

The computer developer is said to be an early adopter of the cryptocurrency, trying his hand at mining BTC as well as claiming to have communicated with Satoshi Nakamoto several times. He claims to have no regrets over the transaction (despite 10,000 BTC being worth over $400 million today).

12 Years In Review

After Satoshi Nakamoto launched the new monetary system in early 2009, adoption was slow and interest was relatively secluded to the developer circles.

This pizza transaction in 2010 proved that Bitcoin had value in the real world and propelled the interest and proved its usability. To illustrate this point, consider that Silk Road (the dark web marketplace that utilized Bitcoin) was launched just nine months later.

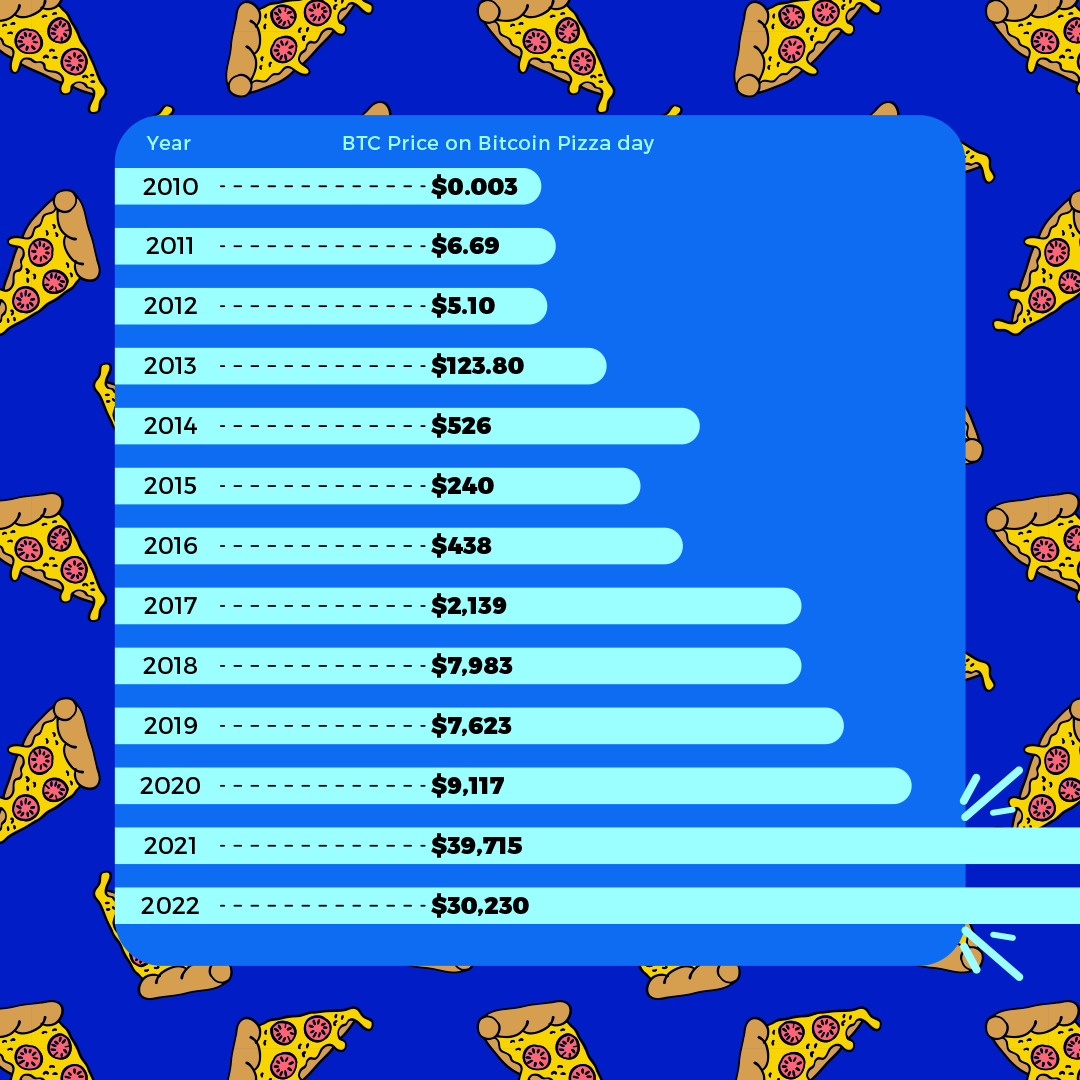

Let’s take a look at the Bitcoin prices over the past 12 years, indicating the price on the day that we have come to associate with Bitcoin and pizza.

2010 ($0.003)

The first real world Bitcoin transaction took place, costing Laszlo Hanyecz 10,000 BTC for 2 pizzas. Worth roughly $0.003 at the time, the pizzas cost him a fair price of $30. According to data, following this transaction, the price over the next five days started increasing.

By July 2010, 1 BTC was worth $0.08, illustrating a 2,566% increase.

2011 ($6.69)

Bitcoin crossed the $1 mark for the first time in its history in April 2011. As Bitcoin adoption steadily increased the market entered a bull run.

On 22 May it was worth $6.69 rising to $29.60 in early June. However, the price decreased following this new all time high and closed the year at $4.72.

2012 ($5.10)

Bitcoin was trading at $5.07 on Bitcoin Pizza Day this year, and experienced a quite unimpressive year of sidewards trading before and after that.

In November 2012 it underwent its first halving, reducing the miners’ rewards from 50 BTC to 25 BTC sparking a price increase in late December that reached $13.45.

2013 ($123.80)

While Bitcoin opened the year at a modest $13.30, the market had plenty more in store. In April the price crossed $200 for the first time, trading at $230 on 9 April.

On Bitcoin Pizza Day 2013, the price was sitting at $123.80.

Then in December, the price shot above $1,000 for the first time, hitting $1,038 on the 3rd. While very exciting, it would be another 3 years until the price reached over $1,000 again.

This year also marked the People’s Bank of China banning BTC trading while across the pond the first Bitcoin ATM was installed in Vancouver.

2014 ($526)

2014 was less kind on the markets. It all began in February when Mt Gox (Bitcoin’s biggest and most important crypto exchange at the time) filed for bankruptcy, reporting that they lost over 744,000 BTC in users' funds.

This sparked a mass sell off sending the price plummeting -68% from $1,147 (December 2013) to $360 in mid-April. By the time 22 May rolled around the price had moderately increased to $526.

After hitting a peak of $665 in early June the price steadily declined for the next 6 months.

2015 ($240)

The market continued on its downtrend, while insiders speculated that this was due to an announcement from Bitstamp that they had lost 19,000 BTC in a hack. This year also marked the launch of the Bitcoin currency symbol - ฿.

On Bitcoin Pizza Day 2015 the price was $238.17.

With several ups and downs, the crypto entered a bull run towards the latter part of the year, hitting the annual December peak of $465.

2016 ($438)

With an increase in the strength of the network, Bitcoin’s hash rate increased over 1 exahash/second for the first time. Other than that the year witnessed a steady price increase, crossing $438 on 22 May on its way to hitting a peak of $768 on 15 June.

BTC then corrected to $552 in early August and began its gradual climb again. Unfortunately, it narrowly missed the $1,000 mark, however, this was crossed in the first few days of 2017.

2017 ($2,139)

2017 marked an iconic year for Bitcoin. Crossing the $1,000 mark on 2 January the price spent the rest of the year working its way up to the record-breaking $19,783 reached on 17 December.

In early January after the price hit $1,000 it experienced a minor dip before crossing the $1,000 mark again in March, never to go below that again. By Bitcoin Pizza Day 2017, the original cryptocurrency was trading at $2,139, and after a minor setback in September, it began the climb to that top spot.

This year also garnered much attention outside of the cryptocurrency community indicating, and promoting, a strong retail interest.

This year also witnessed the largest U.S. options exchange, Chicago Board Options Exchange, opening Bitcoin futures trading and Bitcoin Cash’s hard fork. The year ended with mass sell offs, which continued into the new year.

2018 ($7,983)

2018 marked the beginning of what has become known as the longest Crypto Winter presenting a year-on-year return of -73%.

After much market volatility, the price dipped and rose to a high $17,135 on 6 January, only to return to this price point again in late November three years later.

On 22 May, BTC was trading at $7,983 and continued on a steady decline. By the end of the year, the price had dropped to a painful $3,214 (although on the bright side it never went below this again).

2019 ($7,623)

As the bear market continued, Bitcoin opened 2019 at $3,764 with nothing too substantial happening in the market until early April.

In just one day the market jumped 18% indicating the start of a much-anticipated bull run. By Bitcoin Pizza Day 2019, Bitcoin was trading at $7,623 before peaking to $12,907 at the end of June.

Unfortunately, this bull run didn’t last too long, experiencing another decline before closing the year at $7,182.

2020 ($9,117)

A year like no other, 2020 marked one of the biggest years in the cryptocurrency’s history.

In March the world was put to a standstill as the global Covid-19 pandemic swept its way across borders. All markets were struck, with Bitcoin being no exception. In just one day the market lost nearly 40% of its value, dropping to lows of $4,915. Very steadily the market saw growth, increasing to $9,117 by Bitcoin Pizza Day 2020, to $10,300 by the end of July.

From September through to the end of the year the price increased 185%, reaching a new record high of $19,850 on 30 November. But this was only the beginning.

The market experienced an influx of institutional investment, with MicroStrategy leading the way. Many other investors also chose to move their funds from the deteriorating US dollar markets and invest them in Bitcoin instead - a clear indication that the attitude to crypto had well and truly changed.

After continuing to hit new all time high records, the cryptocurrency closed the year trading at $28,956.

2021 ($39,715)

Continuing the epic bull run, 2021 saw the Bitcoin market reach a new all time high just eight days into the new year, hitting $40,000 for the first time - over double that of the 2017 all time high.

As institutions continued their investments, the market continued growing, inflating to $47,900 just a month later. By 21 February the market was just shy of $60,000 crossing that threshold on 13 March.

Following several ups and downs, Bitcoin ascended to $68,789.63 in November 2021, marking the most recent all time high. By the end of the year, it was trading at just under $50,000.

2022 ($30,230)

Since the new all time high record was achieved late last year, Bitcoin has struggled to break above the $50,000 mark. Following weeks of market uncertainty, the biggest cryptocurrency took a nose dive after Terra (LUNA) and TerraUSD (UST) crashed.

With all financial markets under strain (alongside many other financial pressures), many investors liquidated their "riskier" assets, causing a mud slide in prices. By Bitcoin Pizza Day 2022 Bitcoin was trading at $30,230.

Celebrate Bitcoin Pizza Day

While crypto investors are feeling the bitter effects of the crypto winter, consider the significant price leaps following each halving. Bitcoin increased from $0.003 in 2010 to $6.69 in 2011. From $438 in 2016 to $2,139 in 2017, and from $9117 in 2020 to $39,715 in 2021. Hold tight, who knows what the Bitcoin price will catapult to in 2024 when the next halving takes effect.

Whether you choose to eat pizza or to buy Bitcoin this Bitcoin Pizza Day, why not get in on the action? With the convenience of Oobit, you can do both from the comfort of your couch, with the convenience of your credit card.

Oobit allows users to quickly and conveniently purchase a wide range of cryptocurrencies through a number of straightforward payment options. Want to buy BTC today? It’s as easy as can be with Oobit.

________________________________________________________

Oobit Technologies Pte, 50 Raffles Place #37-00 Singapore Land Tower, Singapore (048623). is a company registered in Singapore (no:201716443G), that has been approved as Appointed Representative of Oobit Technologies OÜ, Harju maakond, Tallinn, Lasnamäe linnaosa, Väike-Paala tn 2, 11415, (no: 14852617 ). Which is authorized and regulated by the FIU (no: FVR001421 and FRK001304).