Brazil is the world’s most advanced stablecoin economy, yet everyday payments are still broken. This paradox exposes crypto’s biggest gap.

In Brazil, 91.8% of crypto users already hold stablecoins. USDT dominates. And 85% say they want to pay with it every day. But only 37% ever have. Stablecoins have become Brazil’s unofficial second currency, but at the checkout counter, they still do not exist.

Stablecoins Are Everywhere. Except at Checkout

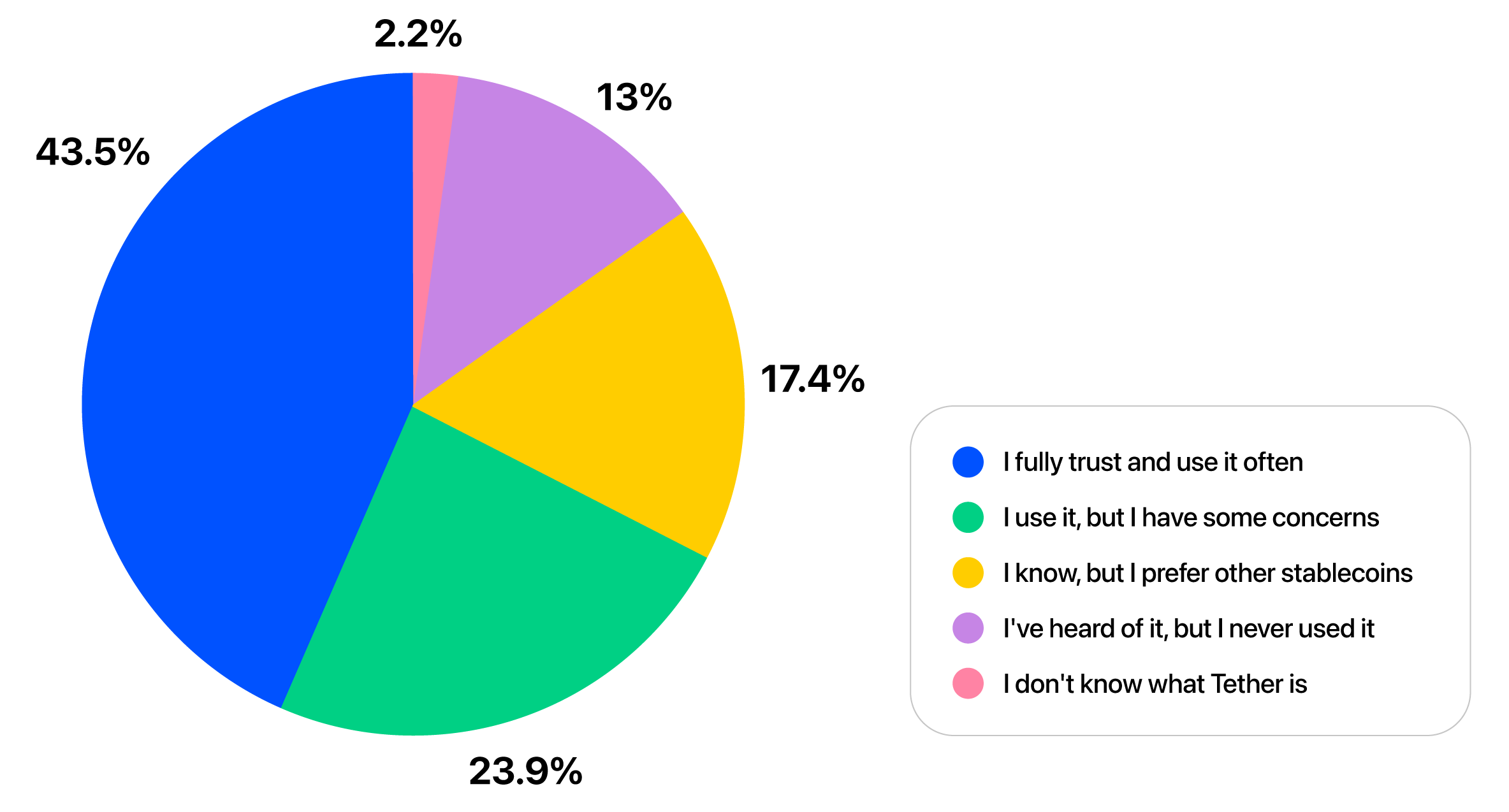

Oobit’s July 2025 survey of Brazilian crypto users aged 23–45 revealed a market that looks mature on the surface. 91.8% already hold stablecoins, 83% of them hold USDT, and 85% want to use crypto for everyday purchases. Yet only 54.3% have ever made a crypto payment, and just 37% have used it in the real world, in-store or online. Satisfaction with payment tools scored only 3.28 out of 5. Stablecoins dominate savings and trading. But when it comes to spending, usage collapses.

The Trust Gap Has Been Solved. The Utility Gap Has Not.

Tether’s position in Brazil is unmatched. With 83% adoption and 43.5% of users saying they fully trust USDT, it has evolved into a default currency for Brazil’s crypto-native class. This level of penetration is rare and deeply significant. It reflects years of consistency, brand resilience, and reliability in a region where financial uncertainty has shaped behavior for generations. But the survey reveals something more important. Brazilian users are no longer in exploratory mode. They are evaluating stablecoins with the same discernment as traditional financial products. They trust USDT. They want to spend it. And the fact that they cannot is the ecosystem’s failure, not theirs.

Brazil shows the truth. Stablecoins won the trust battle. But they are losing the utility war,” said Amram Adar, Co-Founder and CEO of Oobit.

What Advanced Users Are Actually Doing

Brazilian crypto users are not dabbling. They are engaged. They are staking, trading, lending, and using stablecoins as a primary financial system outside of traditional banks. This is what a crypto-native economy looks like. Frequent, intentional, and sophisticated behaviors, all happening in parallel to the fiat system. But when they try to spend, friction is everywhere. High fees. Limited access points. Fragmented user experience. Payment tools that feel half-finished. It is not a product gap. It is an ecosystem gap.

Brazil Is a Mirror. Not an Outlier

Brazil is not unique. It is just sounding the alarm first. The same story is unfolding in Turkey, Nigeria, Indonesia, and Argentina. If stablecoins cannot cross the utility threshold in Brazil, a country with high literacy, deep trust in USDT, and widespread adoption, then the entire global promise of crypto payments is still on hold. Stablecoins are ready. People are ready. The rails are not.

The Next Chapter

The stablecoin era has already begun. But without cost-effective, seamless, and daily-use infrastructure, adoption will remain stuck in a paradox. Trusted but unusable. The question is no longer whether people want to pay with stablecoins. The survey shows they do. The question is whether the ecosystem can catch up.