Volatility is witnessed in all markets, but few as much as Bitcoin. Some traders view it as a bad thing, while others leverage the volatility and use it to their advantage. In this article we’re going to be breaking down what volatility is exactly, the good and bad aspects of Bitcoin volatility, and take a look at what is behind the cryptocurrency’s volatile movements.

What Is Volatility?

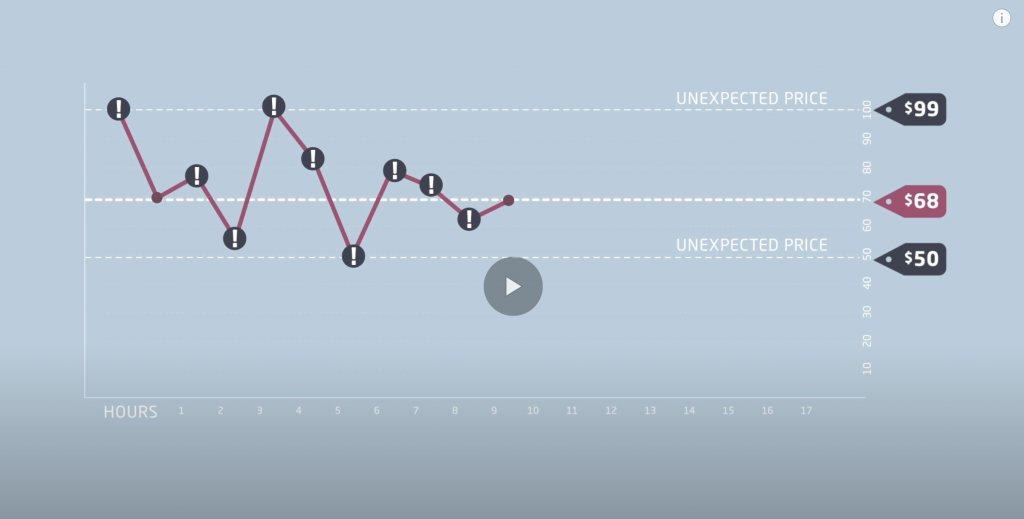

Before we dive into Bitcoin volatility, let’s cover the basics. Volatility in financial markets is when the price of the asset, whether stocks, commodities or currencies, fluctuates and delines excessively over a certain period of time. Usually these changes are unpredictable, and are generally viewed as a negative attribute.

Volatility is measured by looking at the range and speed at which an asset’s price moves. The more it increases and decreases in a short range of time, the higher the asset’s volatility. However, not all volatility is a bad thing, volatile assets tend to fall into the “high risk, high reward” category, so it’s up to the investor to do their research and determine if it’s a worthy venture.

Why Is Bitcoin So Volatile?

Now that we understand what volatility is, let’s dive into why Bitcoin is so volatile. So much so, that it is largely considered to be one of the most volatile assets out there. That’s not necessarily a bad thing though, but more on that later.

A classic tale in Bitcoin volatility is around the time of its ATH (all time high) in December 2017. From 15 to 17 December 2017 the price rose from $17,900 to nearly $20,000, and then rapidly plummeted below $14,000 on 22 December.

That’s a significant movement in the market for a week, and is one of Bitcoin’s most volatile periods. Ironically, this small period of volatility introduced the digital currency to many investors around the world.

What Causes Volatility?

There are a number of factors to look at when trying to understand why the original cryptocurrency is so volatile.

Sensitive To News

Bitcoin adopters typically react to negative news stories by immediately selling. This creates an imbalance in the supply and demand and instigates a price drop. The same can be said when the news is positive, buyers are quick to pick up the cryptocurrency thereby increasing its value. Either way, a recipe for volatility.

Changing Conceptions About Its Value

Bitcoin is often likened to gold and silver when compared to fiat currencies. Fiat currencies are susceptible to inflation, while Bitcoin, gold and silver will only ever have a limited amount, making them deflationary. When fiat currencies take a dive, investors move their money to more stable assets.

Supply and Demand

Bitcoin can be used as both a store of value and a method of transfer. When either of these increase or decrease suddenly due to other markets or the news, the price is affected.

Whales

This term refers to individuals or corporations that hold large amounts of BTC ($10m+). When a whale sells large quantities of Bitcoin, this has a ripple effect in the market and naturally affects the price, thereby increasing volatility.

FUD and FOMO

These terms, Fear Uncertainty Doubt and Fear Of Missing Out, are some of the terms used to describe when influential people make bold statements or try to manipulate the market through their opinions and/or platforms. Creating FUD around Bitcoin often causes holders to sell, affecting the price, while FOMO tends to lead people into buying BTC.

The Upside to Bitcoin Volatility

Looking at the good and bad aspects of Bitcoin volatility, let’s touch on the benefits. While prices might fluctuate unpredictably, the potential to make money through buying and selling the cryptocurrency is hugely promising. Each year, traders make millions of dollars by buying when the market is low, and selling when the market is up. With the rise in exchanges and P2P marketplaces, the volatility can easily be taken advantage of.

Bitcoin volatility increases the potential for returns on investment, making it an excellent tool for day traders, as well as individuals using the currency for wealth preservation.

The Downside to Bitcoin Volatility

The disadvantages to Bitcoin volatility is that when the markets take a turn for the worse many investors lose money, usually as a result of making rash decisions. When the cryptocurrency enters a bear market, it’s important to stay calm and ride out the wave.

Another downside is that Bitcoin volatility scares off a lot of investors, leading to lower adoption rates. However, adoption is key to growth, the higher the adoption rates, the more the value increases. While the asset is considered risky by many, the potential for this new age digital asset is unlimited.

Why We Need It

As with anything, there are always the good and bad aspects, especially when it comes to Bitcoin volatility. As Bitcoin is still a relatively new asset, volatility is inevitable. As more people invest and exchange the cryptocurrency, the higher the adoption, the higher the price rises.

While Bitcoin may be known for having higher volatility rates, it’s worth remembering that volatility is a side effect that comes with growth. If the last ten years have shown us anything, it’s that Bitcoin is an unstoppable and unpredictable force.

_________________________________________________________

Oobit Technologies Pte, 50 Raffles Place #37-00 Singapore Land Tower, Singapore (048623). is a company registered in Singapore (no:201716443G), that has been approved as Appointed Representative of Oobit Technologies OÜ, Harju maakond, Tallinn, Lasnamäe linnaosa, Väike-Paala tn 2, 11415, (no: 14852617 ). Which is authorized and regulated by the FIU (no: FVR001421 and FRK001304).